It seems like we've had even more to celebrate this month than the 4th of July. As it turns out, June 2023 was a banner month for Real Estate - especially in Williamson County!

Before I get carried away with the good news in housing, I do realize that some Buyers are hoping for a "crash" in home values. And I can understand the luster of imagining buying homes in a flash sale. But after living and working during the Great Recession, I saw that when home values dropped dramatically, it was because of a lot worse things happening in our economy, and it was frightening. I won't wish that on anyone ever again.

So far, many predictions show we're heading for a "soft landing" in this economic correction. We may not be out of the woods yet -- and that's okay. But I consider a soft landing as getting off easy. Some of us in the Greater Nashville area may have already seen the "bottoming out" of our markets!

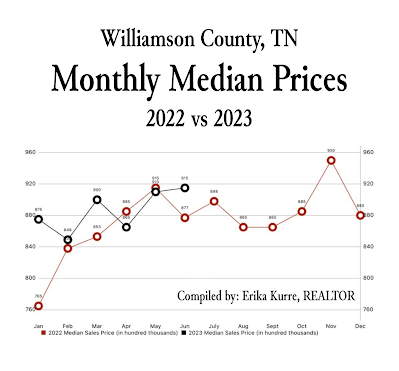

Williamson County Upswing

Take Williamson County, for example. We are sitting at the second-highest median price OF ALL TIME. $915,000 is more than double the national median home price of $426,000.

The black line represents this year so far. The red line represents 2022's median prices.

A similar trend is found even closer to home -- in Grassland. The median price in the past 13 months has been extremely volatile, due to the smaller number of homes sold in such a specific area (fewer homes to average with). But you can see we're following the same general trend -- prices keep increasing.

Grassland's median price for June coming in even higher than the county -- and our highest price in the past 13 months at least -- at $968,000.

This is after at least three consecutive months of increases for both Grassland and Williamson County as a whole. And the increases between May and June weren't as noticeable as between April and May -- but they're increases nonetheless.

We saw through the Great Recession that Williamson County typically fares better than the Greater Nashville area when it comes to economic downturn. Our Mayor, Rogers Anderson, and city aldermen have worked for the past 15 years to further insulate our county should we be faced with another major Recession or Depression. The Mayor told me several years ago that they learned from the Great Recession what makes our county work. So they've been diligently recruiting more headquarters and white-collar positions to call Williamson County home. He said those positions are the last to lose their jobs. And as long as people have jobs, they can buy groceries, houses and keep their world turning.

Is Work Working?

The most recent snapshot of the US job market isn't as bad as expected -- with some reports showing positive gains among the negative. ADP Research Institute reports a growth in the US job market of more than a half-million private sector jobs in June. This is more than double what Wall Street expected. On top of that, ADP reports an increase in pay by 6.4% compared to June 2022.

Housing starts for new construction were at the highest level seen in more than a year -- the highest recorded since 2016 as of May. The National Association of Home Builders reports confidence rose 5 points during June -- the first positive reading on the index in 11 months. This is significant because home builders are often on the conservative side and are considered. a leading indicator in the market, just because of the close attention they pay to economics, especially since the Great Recession.

Among the items builders taking notice of is our dramatically low inventory -- the amount of homes For Sale is among the lowest on record across the country, and here in Middle Tennessee as well.

Local Supply

At a time of year when supply typically increases, the amount of homes we're seeing hit the market locally is struggling to take flight. This graph I made illustrates that:

The blue line represents our inventory this year so far in 2023. The black line is last year. The red line is 2019 -- our last relatively "normal" year in Real Estate. The curve you're seeing with the red line is how inventory levels typically cycle throughout the calendar year. 2021 was a freak. And our poor little blue line is just struggling to gain any consistency or steam! We cannot get ourselves off the ground this year!

What this does is lead to fewer homes sold, like what you'll find from this graph I made of Grassland. We had the fewest number of homes sold here in more than a year -- half as much as in 2019!

And this is why you see a continued increase in our sales prices. Buyer demand -- as low as it is -- still out-paces our supply.

Buyer Comeback

July is typically a month when Buyers come back into the market after taking a break for vacations and general winding down in June. I don't expect this month to have deviated from that trend once the numbers are out.

Sure, mortgage interest rates inched up past 7% for a couple of weeks before coming back down. But Redfin Chief Economist Daryl Fairweather says we are past the lowest level of Buyer demand. Homebuyer demand has already "bottomed out." She goes on to say that though high mortgage interest rates are still a hurdle for Buyers, the sticker shock is no longer as severe as it was last year. "With home prices back near record highs, Buyers are also less worried that they'll buy a house that'll plunge in value."

As we keep our eye on the larger economy, though, it's expected that despite a pass from the Fed Funds Rate increase in June, we will likely see one in July. Remember -- this is not mortgage interest rates we're talking about.

We're just not out of the woods yet with our US economy as the Fed continues to reign in inflation. There's a possibility we could see another Funds Rate hike in September as well, which could put us into a "modest recession" by the end of the year. But talk of a "modest" recession doesn't give me dread at all.

Home Price Expectations

A recession (as long as it's not a Great Recession) doesn't necessarily mean a retraction of home prices. Windmere Chief Economist Matthew Gardner says other than the Great Recession, home prices historically increase during recessions. "In the 1980 recession, home prices when up by over 6-percent." Home prices dropped almost 2% in 1991. But in 2001, we saw a 6.6% gain in US home prices.

Even at a 2% decrease in Williamson County, we'd be talking about $23,000 off of our $1.144,000 home price here in Williamson County. That's hardly a reason to lose sleep (or sit on the sidelines waiting for it).

State of the Market

Greater Nashville showed more volatility during the Great Recession, and as general practice, its overall numbers are certainly more sensitive to any adjustment in the market.

When you look at how Greater Nashville has changed year-to-year, it's a completely different story than Williamson County. Whereas Williamson County has seen a 4% increase in median sales prices, Greater Nashville is -4%.

Different pockets and neighborhoods will hover above or below that mark... but combined, this is where Davidson County lands as a whole.

Closings are down, days on market are up -- neither of these things are surprising. But it's the difference in price year-to-year that's really worth noting.

I'll leave you with our current Williamson County market snapshot -- all of the information compiled for Williamson County as of the last day of June (the most recent completed month, for stats purposes).

We saw a $40,000 gain in sales price year-to-year -- equaling a 4% increase in both average AND median prices for our local market.

Here in Grassland, here's how our 34 homes sold broke down for the month of June, according to how many homes sold in each neighborhood, and the average of their sales prices:

- Brentwood Pointe: 2 homes sold, $338,250 average

- Windsor Park: 1 home sold, $500,000

- Meadowgreen Acres: 3 homes sold, $555,000 average

- Hillsboro Acres: 1 home sold, $605,000

- Fieldstone Farms: 4 homes sold, $683,750 average

- Battlewood: 1 home sold, $725,000

- Monticello: 2 homes sold, $787,500 average

- Sneed Glen: 1 home sold, $880,000

- Cottonwood: 4 homes sold, $917,500 average

- Cardel Village: 1 home sold, $999,000

- Horseshoe Bend: 1 home sold, $1,080,000

- River Landing: 2 homes sold, $1,105,000 average

- Gardens at Old Natchez: 1 home sold, $1,180,000

- Steeplechase Farms: 1 home sold, $1,275,000

- Harts Landmark: 1 home sold, $1,500,000

- Stonebridge Park: 1 home sold, $1,500,000

- Temple Hills: 3 homes sold, $1,542,000 average

- Legends Ridge: 1 home sold, $1,680,000

- Hillsboro Cove: 1 home sold, $2,840,000

- Laurelbrooke: 2 homes sold, $3,009,000

Click on each of the neighborhood names to see the homes sold there. These links will only be active for the next 30 days!

Need a plan tailored to your needs? Reach out! I'm a Franklin resident and a Multi-Platinum Award-Winning Williamson County REALTOR ranking in the top 1.5% of agents in Williamson County. I am a Million-Dollar GUILD Member of the Luxury Home Marketing Institute, my market insights are regularly featured in broadcast media, and my success planted me on the front page of a December 2021 Nashville-area Magazine. But most importantly, I specialize in helping my friends and neighbors buy and sell homes.

%202.PNG)

Comments