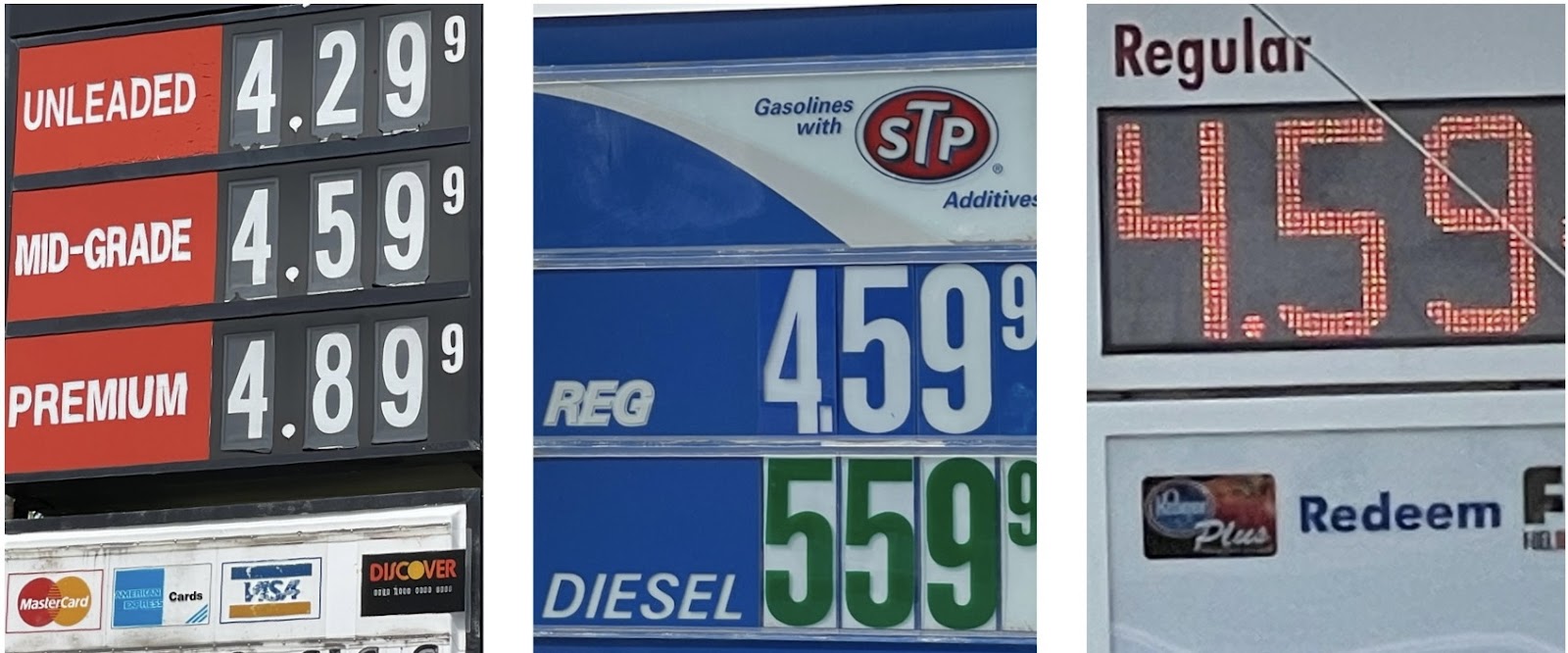

I recently saw a social media post about the price of gas at a shopping club being higher than surrounding non-club stations, and no one commenting seemed surprised. Whether you're shopping at a discount store or not, it seems like everyone and everything is requiring more of our money right now. I mean, you pretty much need Proof of Funds to enter a grocery store!

So what now? And what's next? Where do we go from here.

There's been a lot of talk lately about a recession, housing price correction, incomes not keeping pace, etc. And it's all got legs. I'm seeing the beginning signs of less Buyer tolerance in Real Estate-- to the point where I almost snagged a house for a pair of Buyer clients at $175k below list price last week! The home was almost on the market for 6 days, and not under contract (which is an eternity in today's market). It was overpriced to begin with, which was its main problem. But it would have sold quickly a year ago. Comparing this year to last, it's a very different business today.

What We're Working With

Here in Grassland, our most recent full month of closings was last month. Looking at April 2022, our homes sold for almost 9% over list price on average. *Pricing correctly is key for these results.*

Of our 30 homes that sold here in Grassland last month, our average home list price was $849,510, but actually closed at an average of $927,790. So the average home sold in Grassland during April 2022 was $78,280 above list price.

And there's more. Our 30 homes sold in Grassland is about 33% fewer than the average number of homes sold every April for the past 10 years (which is why we continue to see such a high sales price over list price for the homes priced correctly-- supply vs demand). I believe we continue to have fewer homes sold because there just aren't as many people wanting to sell -- not because Buyers are not wanting to buy. For the homes that are priced correctly here, we're still seeing them fly off the market.

Looming Recession

We won't escape another turn in the economy. It's inevitable. But the way it may look here won't be the same as it will in other parts of the country. That's simply because more people want to live here than in other parts of the country.

But because our prices are going so high and mortgage interest rates continue to rise, that is weeding out some of our Buyer pool, simply because they can't afford to live here anymore. This will lead to fewer Buyers competing in multiple offer situations. Homes will still sell -- and quickly -- but having fewer Buyers lowers the intensity of the market, and the 9% list-to-sales price ratio may look more like only 3% over list price this time next year, for example. And I am already seeing that trend in certain cases.

And speaking of a decrease in intensity, Fannie Mae economists announced last month that they don't expect the next recession to be as severe or last as long as the Great Recession, citing “stronger mortgage credit quality, a far less-leveraged residential real estate and mortgage finance system, and a better equipped mortgage servicer and public policy apparatus, as well as ongoing housing supply constraints relative to demographic demand for housing.”

So those skeptical Buyers hoping for a market crash may be waiting for a train that never comes. By the time we see any potential for a "crash," prices will have risen so high that we likely won't see them go below where they are now. I said two years ago in one of these blog posts that "this is the time of opportunity." I compared Covid Stay-Home orders to the Great Recession housing market, saying that those who were buying homes then were going to be the real winners. "Ten years from now, we will be able to tell who jumped on this opportunity in our housing market." We're only 2 years into that statement, and already we're seeing the results of mirrored success.

Comparing Home Values

If you bought a home in Grassland in March and April 2020 (during Stay-Home orders), you were looking at an average sales price of $801,644. Homes during that time stayed on the market for an average of 41 days. Homes sold almost 3% BELOW list price.

Fast-forward to 2022, during March and April of this year, we had more homes sell, with an average sales price of $1,189,706. Homes in the past two months are only staying on the market an average of 5 days. Homes are selling at almost 7% ABOVE list price between the two months.

In Greater Williamson County, we are looking at an overall average sales price of $1,132,870 during April 2022. Here is how our communities break down:

- Fairview: $526,949

- Spring Hill (Williamson County): $700,585

- Thompsons Station: $840,632

- Nolensville: $912,741

- Arrington: $1,048,762

- Franklin: $1,231,331

- College Grove: $1,578,545

- Brentwood: $1,743,865

In April 2021, our average sales price in Williamson County was $875,997. We've seen a 23% increase in our home values county-wide in one year.

Blue Skies Ahead

As we drive into what many fear ahead, I am actually very optimistic. I lived and worked through the Great Recession here in the greater Nashville area, and remember what and how it all went down.

But today, I actually think any sort of cooling in our market will be good. There is no bubble, and a cooling off doesn't even necessarily mean we'll see our homes lose value. I heard an analogy once of a forest fire that even if it's 75% contained, it's still a forest fire. If a home comes on the market and there are only 3 offers instead of 30, it's still 3 parties competing for that one key. Keep this in mind as you hear about a cooling market.

For Grassland, I see a future where it's more manageable for more people to sell the homes they have here, cashing out on equity, and more easily finding a home that better suits their wants and needs. Our prices will hold firm, and there will be less Buyer competition. This is actually starting to happen already.

So fill up your tank and cruise through this next market shift. You may end up enjoying the ride.

For questions about selling or buying a home, please reach out! I'm a Grassland area resident and a Multi-Platinum Award-Winning Williamson County REALTOR ranking in the top 1.5% of agents in Williamson County. I am a Million-Dollar GUILD Member of the Luxury Home Marketing Institute, my market insights are regularly featured in broadcast media, and my success planted me on the front page of a December 2021 Nashville-area Magazine. But most importantly, I specialize in helping my friends and neighbors buy and sell homes.

Comments